Use depreciation to achieve the best tax results on real estate and property used in business. The Tax Cuts and Jobs Act of 2017 (TJCA) has made further changes to depreciation, including bonus depreciation and Section 179 depreciation.

The Tax Cuts and Jobs Act (P.L. 115-97) as signed by President Trump on December 22, 2017.

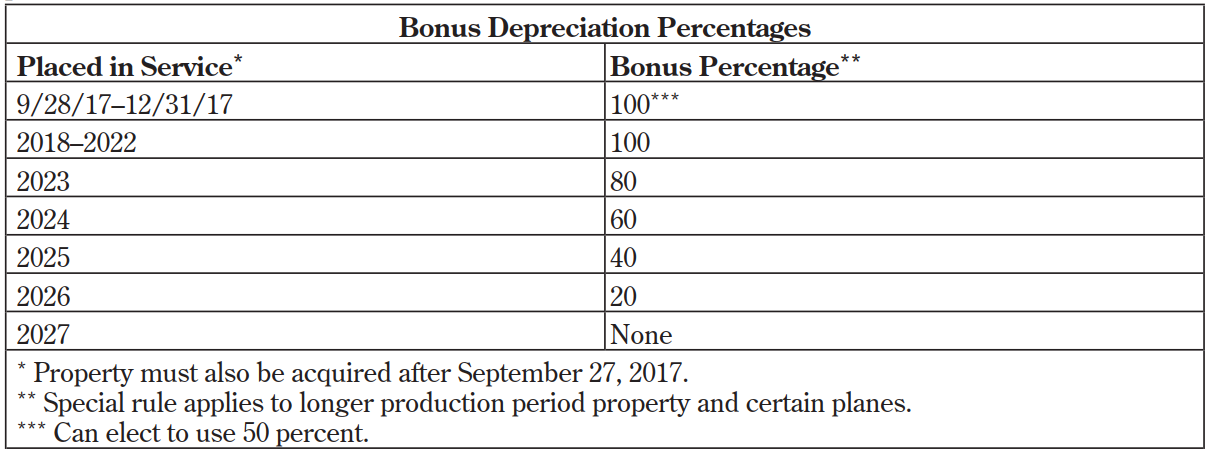

- The TCJA offers 100% bonus depreciation for eligible property through the end of 2022. It begins to phase out between 2023 and 2026 and will end in 2027.

- Section 179 depreciation changes greatly under TCJA

Code Sec. 179

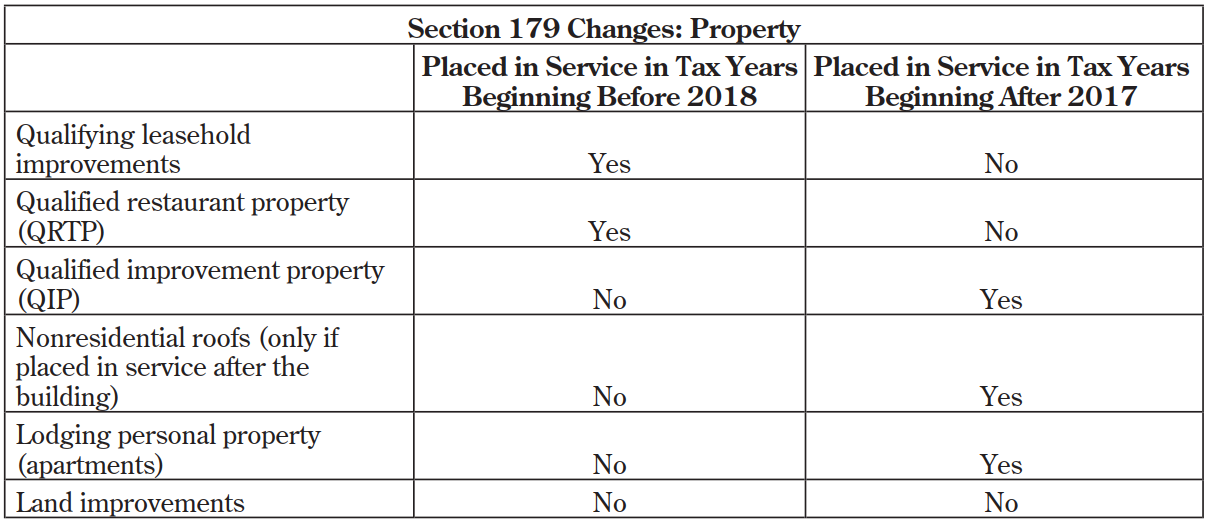

Effective for tax years beginning after December 31, 2017, the 2017 Tax Cuts Act:

- Increases dollar limit to $1 million and investment limit to $2.5 million

- Allows expensing of “qualified improvement property” (i.e. internal improvements to nonresidential real property) and, also, roofs, HVACs, fire protection and alarms, and security systems for nonresidential real property

- Allows expensing for property used in connection with lodging (e.g., in connection with residential rental property)

- Adjusts $25,000 expensing limit on certain heavy vehicles for inflation

Bonus Depreciation

Effective for property acquired after September 27, 2017 and placed in service after that date:

- The bonus depreciation rate is increased to 100 percent but phases down 20 percent each year beginning in 2023

- A taxpayer may elect to apply the 50 percent rate for property placed in service during the taxpayer’s first tax year ending after September 27, 2017.

- Used property qualifies for bonus depreciation

- Films, television shows, and theatrical productions are eligible for bonus depreciation

- Property used by rate-regulated utilities and property is excluded from bonus depreciation

- Property of certain motor vehicle, boat, and farm machinery retail and lease businesses that use floor financing indebtedness is excluded from bonus depreciation

- Corporate election to claim AMT credits in lieu of bonus depreciation is repealed

- Long-term accounting method relief from impact of bonus depreciation extended